Texas Independent Insurance Claims Adjuster Training

How To Become an Insurance Adjuster Online

Get Your Texas Insurance Adjuster License Online

Looking for a career that offers flexibility, great pay, and the chance to help people during their toughest moments? Becoming a licensed insurance adjuster in Texas is your ticket in — and 2021 Training makes it simple. With our 100% online, expert-led courses, you’ll get the skills, confidence, and certification you need to break into this high-demand industry.

Good

$179

Texas All-Lines Pre-Licensing Course

This Texas Insurance Claims Adjuster License course allows you to adjust all claims with the Texas All-Lines License. It includes workers’ compensation claims. This one contains everything you need to get licensed in Texas with our state-approved exam that is online. Texas Adjuster Licensing has never been so easy.

Better

$408

Smart Start Package

The 3-course Smart Start Package includes:

- Texas Insurance Claims Adjuster Licensing for the Texas All Lines License

- Xactimate training

- Practical Adjusting

It’s a popular choice for a smart start down your new career path!

Best

$479

Smart Start + Package

The 4-course Smart Start + Package is our best value and includes:

- Texas Insurance Claims Adjuster Licensing for the Texas All Lines License

- Xactimate training

- Practical Adjusting

- Basics of Construction

If you have no prior construction background, this package is essential for your success as an adjuster.

Why Become a Texas Insurance Adjuster?

Texas is one of the busiest states in the country for insurance claims — from hurricanes and hailstorms to wildfires and freezes. That means insurance adjusters are always in demand.

Whether you’re switching careers, working seasonally, or building a long-term path in claims handling, a Texas All-Lines Adjuster License opens the door to real opportunity.

The Fastest Way to Get Licensed in Texas

You don’t need prior experience, a degree, or even to live in Texas to get started.

Our TDI-approved pre-licensing courses grant you a designation certificate — which means you can skip the state exam and go straight to applying for your license.

No in-person testing

No classroom required

Just complete the course, pass the online final, and apply!

What Makes Our Licening Process Stand Out?

We Answer the Phone & Emails – Have a question? Need guidance? Our friendly, expert team is available to help. We don’t leave you struggling with automated responses or unanswered emails.

The Best Learning Experience – While we aren’t the cheapest option, we offer the best learning experience with expert-designed courses, real-world training, and the support you need to succeed.

Easy, Fast & Cost-Effective – Our state-approved courses are streamlined and efficient, so you can get licensed quickly without sacrificing quality.

You’re Not Alone – With 2021 Training, you’re never left guessing. We walk you through every step, answer your questions, and help you gain confidence in your new career.

Thousands of Successful Adjusters Trained – Our students don’t just pass the exam—they start strong in the industry with the knowledge, skills, and support they need.

Hear What Our Students Say

Invest in Quality Training with a Company That Cares

When you choose 2021 Training, you’re investing in your future. Our goal isn’t just to sell courses—it’s to help you become a successful, well-prepared insurance adjuster.

✅ Comprehensive, easy-to-follow training

✅ Expert guidance at every step

✅ Fast response times—real people, real answers

✅Continuing Education made simple

Don’t settle for a training provider that disappears after your payment. Join thousands of successful adjusters who got licensed with 2021 Training—and experienced top-notch support along the way. We help new adjusters find their footing in the real world of insurance claims adjusting.

Texas Insurance Adjuster Licensing Made Easy

Texas is one of the most in-demand states for insurance adjusters, making it a top choice for professionals looking to enter this lucrative industry. At 2021 Training, we make getting your license simple and stress-free with our fully online, expert-led courses.

Skip the State Exam – Our courses grant a designation letter that exempts you from the Florida state exam, making it the fastest and easiest way to get licensed.

100% Online & Self-Paced – Study at your convenience, from anywhere.

Expert-Designed Training – Learn from industry professionals.

Our Texas Insurance Adjuster Courses

What You'll Learn

Our Texas insurance adjuster training doesn’t just help you pass a test — it teaches you what the job actually requires:

Property damage assessment

Claims writing with Xactimate

Policy interpretation

Catastrophe adjusting basics

Best practices for documentation & customer interaction

All guided by seasoned instructors who’ve worked in the field.

Start a Career That Goes Where the Storms Go

As a licensed Texas insurance adjuster, you’ll be qualified to respond to all kinds of weather disasters:

🌪 Hurricanes

🌧 Floods

🌩 Hailstorms

🔥 Wildfires

❄ Winter storms

🌬 Tornadoes & high winds

Storm season brings opportunity — but only if you’re ready.

Not in Texas? No Problem.

If you’re in a non-licensing state such as Colorado, District of Columbia, Illinois, Maryland, Massachusetts, Missouri, Nebraska, New Jersey, North Dakota, Ohio, Pennsylvania, South Dakota, Tennessee, Virginia, or Wisconsin, you can use our course to get a Texas Insurance Claims Adjuster License. Most companies will want you to have an insurance adjuster license even if your state doesn’t require one.

At 2021 Training, we understand that starting a new career can be daunting, especially in a specialized career field like insurance adjusting. That’s why we’ve tailored our Texas all lines adjuster licensing training programs to cater to different levels of expertise and backgrounds. Let’s explore the three distinct packages we offer to set you on the path to success. The team at 2021 Training is committed to guiding you seamlessly through the process of obtaining your Texas Insurance Claims Adjuster License or the Designated Home State Texas Insurance Claims Adjuster License. We are dedicated to guiding you through the process of Texas insurance adjuster licensing with our courses and training for the Texas All-Lines adjuster license.

Why Start Now?

The best time to start is always now. In the dynamic world of insurance claims adjusting, being prepared before major events like hurricanes is crucial. By starting your Texas adjuster licensing early, you position yourself to seize opportunities as they arise. Without your license, these opportunities simply won’t be available.

The Ease of getting an Insurance Claims Adjuster License with 2021 Training

Are you ready for an exciting new career that gets you out of the cubicle? 2021 Training makes it easy to get your insurance adjuster license for Texas residents and those who live in states without their own adjuster licensing such as: Colorado, District of Columbia, Illinois, Kansas, Maryland, Massachusetts, Missouri, Nebraska, New Jersey, North Dakota, Ohio, Pennsylvania, South Dakota, Tennessee, Virginia or Wisconsin. Our Texas All-Lines and P&C Adjuster Pre-Licensing Courses are 100% online, convenient, and taught by an instructor who has been in the field and has real-world wisdom to share.

Texas has streamlined the process of becoming an insurance claims adjuster, and at 2021 Training, we make it even easier. Our online course allows you to learn at your own pace, from the comfort of your home. Once you complete our state-approved course, you’ll receive a completion certificate and can apply for your license without any further testing.

How to get your Texas Insurance Claims Adjuster License.

- Claim residency in Texas OR a state that does not provide licensing for insurance adjusters as listed above.

- Take a state certified All-Lines Texas Insurance Claims Adjuster Pre-Licensing Course.

- Pass the final exam with a score of 70% or higher.

- Get required fingerprints.

- Submit your online application to the Texas Department of Insurance.

Important: You will be required to submit the following to the Texas Department of Insurance when applying for your insurance adjuster license:

- Course completion certificate from class taken

- $50 state-mandated application fee

- Fingerprint receipt

Frequently Asked Questions about Texas Insurance Adjuster Licensing

If you are looking for a new career as an insurance claims adjuster, here are a few frequently asked questions by people just like you, who are looking into what it takes to get licensed as an insurance adjuster. It is never too late or too early to start your journey with us!

What is an Insurance Adjuster?

An insurance adjuster is a person in charge of the evaluation of insurance claims. Their job is to determine the company’s liability and whether it falls under the terms of the owner’s policy. There are different types of adjusters. They may work for the insurance company or be hired by the claimant (the latter are known as public adjusters). They can also work as an independent adjuster.Becoming a Texas insurance adjuster is not difficult, but anyone hoping to become an adjuster must first obtain a license.

How Do You Get Your Insurance Adjuster License?

- Claim residency in Texas OR a state that does not provide licensing for insurance adjusters as listed above.

- Take a state certified Texas All-Lines Pre-Licensing Course.

- Pass the final exam with a score of 70% or higher.

- Get required fingerprints.

- Submit your online application to the Texas Department of Insurance.

Important: You will be required to submit the following to the Texas Department of Insurance when applying for your insurance adjuster license:

- Course completion certificate from class taken

- $50 state-mandated application fee

- Fingerprint receipt

What is the Best Recommended Course?

Texas All-Lines Pre-Licensing Online Course

This class meets the Texas Department of Insurance education and testing requirements for your adjuster license needs. Simply take this class and get your certificate of completion, then submit the state application along with fingerprints to get your Texas All-Lines Adjusters License. This online self-study course includes the Study Guide, Exam and Certificate. Sign up and log on to start now!

Note: This is not for a Public Adjusters License.

What are the Requirements for Becoming an Insurance Adjuster?

- Must be at least 18 years of age or older

- Must be trustworthy

- Must reside in the state practicing in or in one that has reciprocity

- Must submit the appropriate application and fees to the State of Texas

- Must complete an approved pre-licensing course such as ours and pass our state-approved final exam OR

- Must pass the Pearson VUE state exam

What is the Licensing Process?

- Take our approved pre-licensing course and pass our state-approved final exam with at least a 70%

- Have your fingerprints taken through the state-contracted vendor IdentoGO

- Submit your adjuster application via Sircon.com

How Long Does It Take to Get Licensed?

- Our course is a 32-hour content course with 8 hours of self-study/homework

- These 40 hours above coupled with the 3-hour exam totals 43 hours

- I’ve seen some people work through the course from start to finish within 3-4 days

- Once you’ve passed the exam and received your certificate of completion from us, had your fingerprints taken, and submitted your online application, it will take the state anywhere from 1-5 business days for your application to be approved.

What Kind of Training is Required?

- Licensing class is required to get your license.

- Xactimate software training to learn the most popular claims adjusting software for property claims

- Basics of Construction class for those with no construction experience to introduce you to basic knowledge of construction principles

- Certification training at the IA firm level

Are There Different Types of Adjuster Licenses?

- The All-Lines Adjuster license will license you to adjust all “lines” of insurance such as property, auto, crop, farm & ranch, aviation, marine, workers’ compensation, etc. The All-Lines Adjuster license is the most inclusive license in Texas and the one we recommend to our students..

- The P&C (Property & Casualty) Adjuster license will license you to adjust all lines of insurance as noted above with the exception of workers’ compensation claims.

- The Workers’ Compensation Adjuster license will license you to only adjust workers’ compensation claims.

- In Texas, there is the Public Adjuster license (a Public Adjuster is one that represents the insured in the claims adjusting process) and then the All-Lines, P&C and Workers’ Compensation Adjuster licenses where you will represent the insurance carrier you are adjusting claims for. We do not offer courses for Public Adjusters.

- With the All-Lines, P&C and WC adjuster licenses you can work claims as a Staff Adjuster working directly for the insurance carrier or as an Independent Adjuster working through an IA (Independent Adjusting) firm.

- With the All-Lines, P&C and WC adjuster licenses you can work claims as either a Field/Outside Adjuster or a Desk/Inside Adjuster either as a Staff Adjuster or as an IA (Independent Adjuster)

What is the Cost of Getting Licensed?

- The Texas Adjuster License application fee is $50 and the fingerprinting fee is $70.

What are the Steps After Passing the Exam?

Once the exam is behind you, all you need to do is apply for the license. The process is quite simple. Texas requires you to submit your fingerprints for a background check. The submission is checked by the Texas Department of Public Safety and the FBI to ensure that your criminal history records are spotless.Every couple of years, you will need to do a few additional steps to renew your Texas Insurance Adjusters License and keep it active. 2021 Training can help you with pre-licensing and help you maintain your Texas Adjuster\’s License once you acquire it. Contact us today to learn more about our courses and get started as a Texas Insurance Adjuster.

Where do I get my fingerprints?

All fingerprints for the Texas Department of Insurance must be taken through IdentoGO Centers by MorphoTrust USA. You will find the “Fingerprint Requirements and Instructions” on the TDI website. Simply make an appointment, go to one of their locations and get your fingerprints scanned. They will give you a receipt which you’ll submit with your state application. If you are not a Texas resident, then most IdentoGO centers still offer electronic fingerprinting for an additional out-of-state fee.

We're Here to Support You!

Should you have any questions about obtaining your Texas Insurance Claims Adjuster License or choosing the right training package for your career goals, our team at 2021 Training is just a call away. We are committed to supporting you every step of the way while you study for your all lines adjuster licensing in Texas, ensuring that your journey into the insurance adjusting field is as smooth and successful as possible.

Latest From The Blog

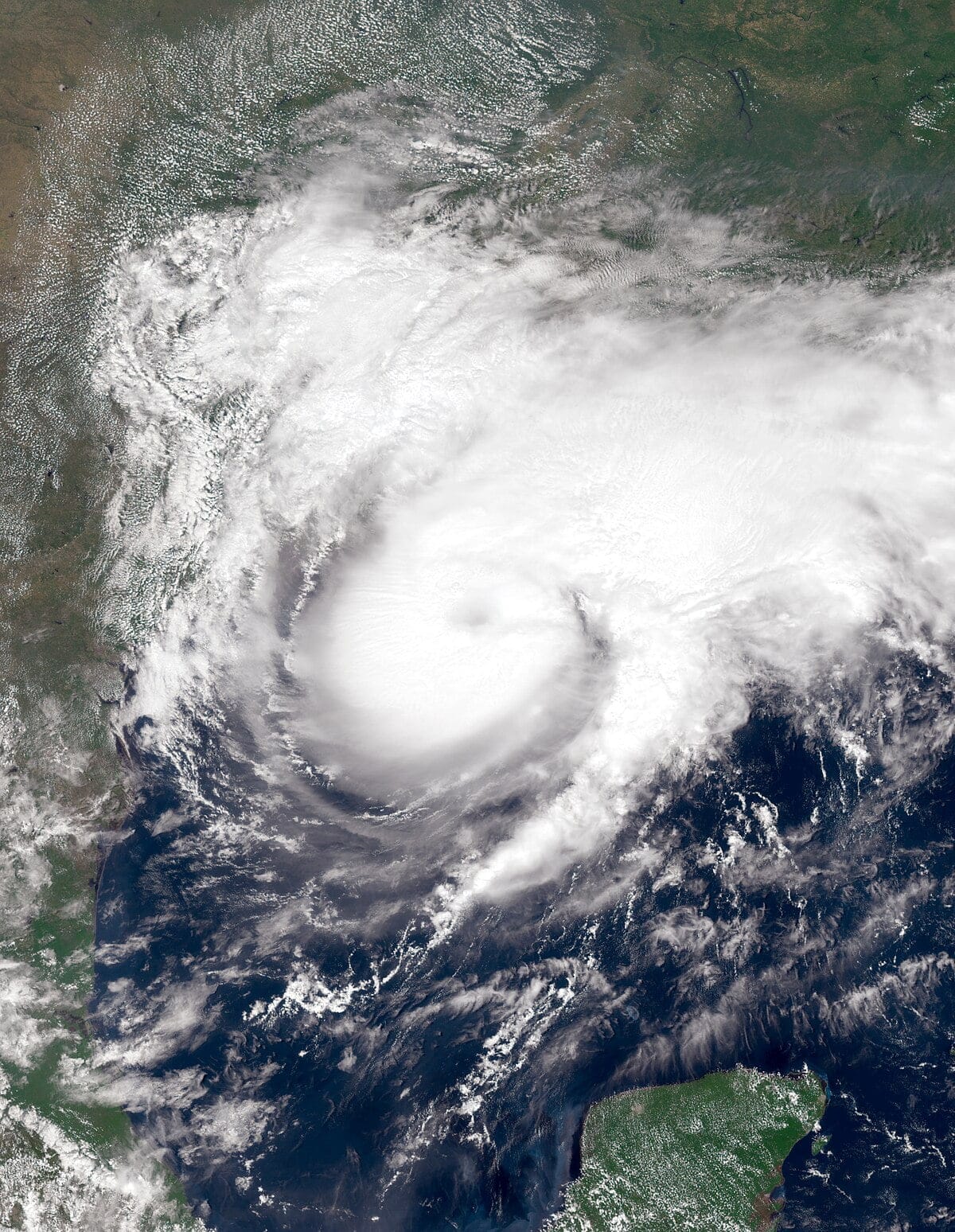

Hurricane Milton: A Call for Insurance Adjusters to Step In

Hurricane Helene on the Gulf Coast

Tropical Storm Francine

Texas Claims Adjuster License with 2021 Training

Becoming a claims adjuster in Texas is a rewarding career path that allows you to help people recover from losses while building long-term professional stability. To qualify, you must meet state requirements, complete pre-licensing education, and apply through the Texas Department of Insurance (TDI). 2021 Training makes the process simple with state-approved, 100% online courses, exam prep, and continuing education.

Licensing Requirements

Must be 18 or older with a high school diploma or GED.

Completion of a TDI-approved pre-licensing course.

Fingerprinting and background check required.

Types of Licenses in Texas

All-Lines Adjuster License (covers property, auto, workers’ comp, farm & ranch, and more).

Other options include Property & Casualty, Workers’ Compensation, and Public Adjuster licenses.

Why 2021 Training?

TDI-approved Texas Adjuster Pre-Licensing Course with online final exam.

Flexible, self-paced training with video lessons, interactive tools, and practice exams.

Ongoing resources for continuing education and license renewal.

Application Steps

Complete a pre-licensing course.

Pass the online final exam.

Submit fingerprints for background check.

Apply for your license with TDI.

Continuing Education & Career Growth

Texas requires 24 CE hours every two years, including 2 hours of ethics.

2021 Training offers CE packages and advanced certifications in property, auto, workers’ comp, and catastrophe adjusting.

Career paths include staff, independent, or public adjuster roles, with networking and professional associations to expand opportunities.

Key Takeaway

With 2021 Training, you can complete licensing requirements online, gain industry-specific skills, and maintain your license with CE courses — opening the door to a stable, high-demand career in insurance claims adjusting.